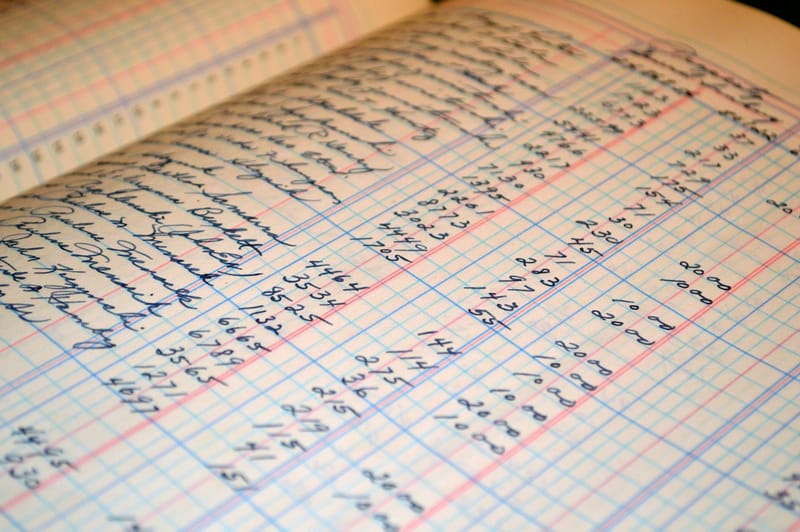

e-ledger

e-Ledger is the process of creating legal ledgers, which are required to be kept in accordance with the Tax Procedure Law and the Turkish Commercial Code in Türkiye, in an electronic file format in accordance with the format and standards determined by the Revenue Administration (GİB). This regulation aims to record the ledgers electronically without printing, to ensure the immutability and integrity of these records, and to guarantee the accuracy of their source. e-Ledger is also a set of legal and technical regulations that allow it to be used as a means of proof by the relevant authorities.

Businesses that are e-Invoice taxpayers are also required to keep an e-Ledger. This system aims to control the accounting records of businesses more tightly. In the traditional system, legal books were kept physically throughout the year and prepared collectively at the end of the year. However, with the e-Ledger regulation, taxpayers are required to send their books electronically to the Revenue Administration every three months without waiting until the end of the year.

With the e-Ledger system, there have been significant changes in the accounting recording processes of businesses.

Previously, in order to reduce the number of pages in legal books, various documents were combined and recorded under a single journal entry. However, with the e-Ledger regulation, a separate journal entry was created for each document and a requirement was made to define an appropriate e-Ledger document type for each document. This enabled accounting records to become more detailed and organized.

With Navapp's e-Ledger solution, you can easily manage the following transactions:

- e-Ledger record entry screens: Navapp has designed record entry screens in accordance with e-Ledger regulations. These screens ensure that accounting records are made in accordance with e-Ledger standards.

- e-Ledger file formats: e-Ledger file formats suitable for system integrators can be created. This ensures that the files to be sent to the Revenue Administration are prepared in the correct format and that the integration processes run smoothly.

- Periodic e-Ledger preparation and period closing: You can easily prepare your e-Ledger at the end of the period and perform period closing transactions. This feature prevents the entry of a journal entry into a closed period, thus ensuring that accounting records are in order.